12月4日,新加坡金融管理局宣布颁发了四张数字银行执照——

全面数字银行牌照两家:

1) Grab和新加坡电信组成的财团

2) 单独提交申请的Shopee母公司冬海集团(Sea Group)的全资子公司。

批发数字银行牌照两家:

3) 蚂蚁集团的全资子公司,

4) 以绿地金融投资控股集团为首的财团。

预计数字银行将于2022年起在新加坡投入运营。

新加坡金管局称,全面数字银行可提供全面银行服务,包括为零售客户提供存款服务。但它的本金至少需要15亿新元,同时也需要如本地传统银行一样,符合金管局各项资金流动性要求。

批发数码银行资本门槛则只有1亿新元,但它们只能为中小企业和非零售客户提供服务。

在获得总计两张全面数字银行执照的企业中,新电信是新加坡最大的国有企业之一,也是新加坡主要的电信服务提供商。

Grab是一家立足东南亚市场的出行平台,近年来服务范围已经广泛涉及送餐服务、电子支付等。

冬海集团则是一家新加坡本土的互联网公司,业务范围涉及移动支付、游戏和电子商务。

新加坡金管局还颁发了两张批发数码银行执照。阿里巴巴集团旗下的蚂蚁集团以及中国绿地集团旗下的绿地金融联合香港联易融数字科技和北京中合供销股权投资基金管理公司组成的联合财团各拿下一张。

新加坡银行业普遍对政府颁发数字银行执照表示欢迎,不少银行业者认为,新的数字银行有助于促进行业整体竞争,提升服务水平,令银行业和消费者从中获益。

不过,新加坡最大的星展银行很快发出了一个「欢迎」 – 不忘记告诉大家星展几年前就开始做数字银行了,而到现在已经有了300多万用户。

新的数字银行正面和星展、华侨、大华正面竞争其实并不容易。

数字银行并不会给传统大行业务带来多大的威胁。但是,在一些新的或者发展中的业务上,新的玩家还是有很多发挥的空间的。

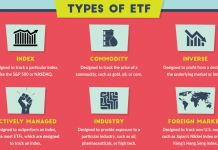

The difference between the two types of licenses is simple.

Digital Full Banks

Digital full banks are allowed to take deposits from retail customers like any of us.

This function is something familiar to all Singaporeans with a savings account.

Very much like the DBS banks and OCBC banks which we are familiar with, but fully digitalised.

Simply put, all your banking services will be done online without the need to head down to a physical branch.

Digital Wholesale Banks

Digital wholesale banks are more catered towards the non-retail part of banking.

Think along the lines of providing banking services that cater to the monetary needs of small and medium-sized enterprises (SMEs).

Singapore Digital Bank License: 14 Applicants Shortlisted, 4 Awarded

Out of the total 21 applicants that submitted their applications for the banking license, 14 of them were shortlisted.

As of today, MAS awarded the Grab-Singtel consortium, Sea with the full banking licences. Singaporeans can expect two new full digital banks in town.

Ant and a consortium comprising Greenland Financial Holdings, Linklogis Hong Kong, and Beijing Co-operative Equity Investment Fund Management got the wholesale bank license.

The applicants presented their proposals via virtual meetings over the past few months alongside their competitors before emerging as winners.

They will be evaluated based on:

- sustainability

- business model

- value proposition

- use of technology

These were some of the applicants who got shortlisted back then:

| Applicants/ Consortiums | Type of Digital Bank License | Shortlisted Applicants | Winner? |

|---|---|---|---|

| Singtel and Grab | Digital Full Bank License | Yes | Winner |

| Sea Limited | Digital Full Bank License | Yes | Winner |

| Razer, Sheng Siong Holdings, FWD, LinkSure Global, Insignia Venture Partners and Carro | Digital Full Bank License | Yes | – |

| V3 Group, EZ-Link, Far East Organisation, Singapore Business Federation, Sumitomo Insurance Co Ltd and Heliconia Capital Management | Digital Full Bank License | Yes | – |

| MatchMove’s consortium with Singapura Finance | Digital Full Bank License | Yes | – |

| Standard Chartered and NTUC Enterprise | Digital Full Bank License | TBC | – |

| Ant Financial | Digital Wholesale Bank License | TBC | Winner |

| iFast Corporation, Hande and Yillion | Digital Wholesale Bank License | Yes | – |

| ShengYe Capital, Phillip Capital and Advance AI | Digital Wholesale Bank License | Yes | – |

| AMTD, Xiaomi, SP Group and Funding Societies | Digital Wholesale Bank License | Yes | – |

| Greenland Financial Holdings, Linklogis Hong Kong, and Beijing Co-operative Equity Investment Fund Management | Digital Wholesale Bank License | Yes | Winner |